| Qualifying days | 0 |

|---|---|

| Waiting days | 0 |

| Daily SSP | £0.00 |

| Total SSP | £0.00 |

Disclaimer: This calculator provides an estimate only and does not replace official NHS or HMRC guidance.

NHS Statutory Sick Pay Estimator

Illness can interrupt both work and income, especially for healthcare professionals working demanding schedules. For employees within the public health system, understanding sick pay rules is essential for financial stability. The NHS Statutory Sick Pay Estimator is designed to simplify this process by helping staff estimate what they may receive during sickness absence.

Instead of navigating complex policies and figures manually, employees can gain clarity on weekly payments, entitlement periods, and how workplace terms interact with government rules. This clarity supports better planning, reduces stress during recovery, and helps individuals focus on health rather than paperwork or uncertainty about income support.

What is NHS Statutory Sick Pay Estimator ?

The NHS Statutory Sick Pay Estimator is a practical tool that helps calculate NHS Statutory Sick Pay alongside statutory sick pay obligations set by the government. It works as an SSP Estimator that considers SSP, the standard SSP rate, and the fixed amount of £116.75 per week,

while reflecting how NHS sick pay schemes operate. For many NHS staff, this estimator bridges the gap between basic statutory entitlements and contractual benefits such as enhanced NHS sick pay entitlement, making calculations easier and more transparent.

Statutory Sick Pay (SSP) Calculation – Step-by-Step ?

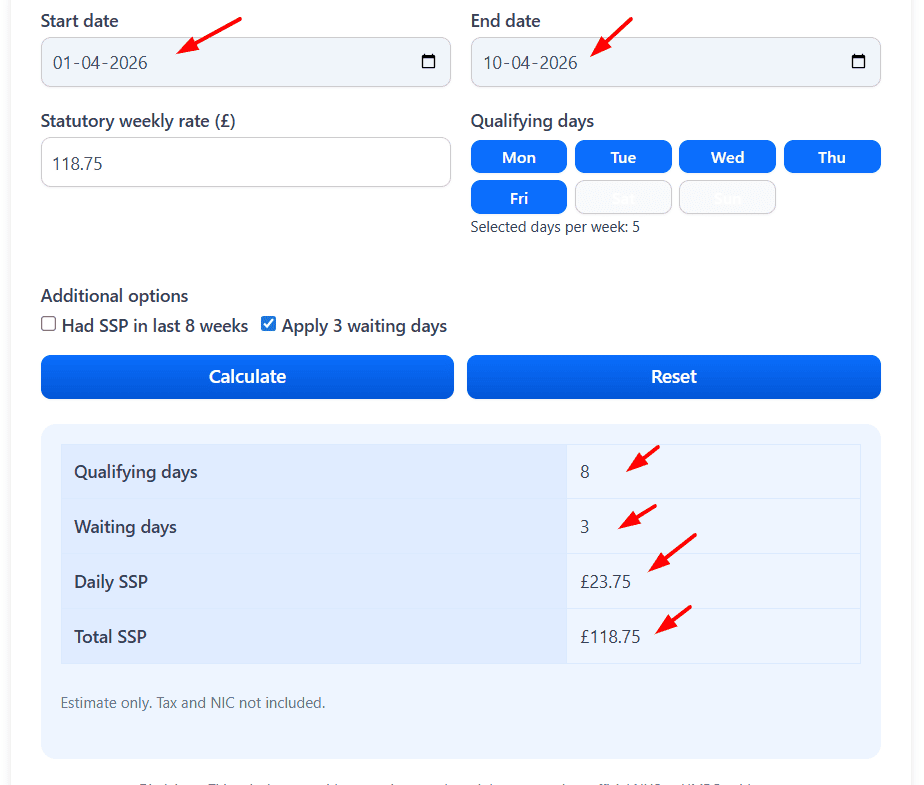

Suppose: An employee works Monday to Friday, was off sick for 10 days, has not received SSP in the last 8 weeks, and the standard SSP weekly rate applies. What would their estimated SSP payment be?

Input Values (Form Filled Example)

Start Date: 1 April 2026

End Date: 10 April 2026

Statutory Weekly Rate: £118.75

Qualifying Days: Monday to Friday (5 days per week)

Had SSP in last 8 weeks: No

Apply 3 waiting days: Yes

Step 1: Qualifying Days in the Period

The calculator checks all dates between 1 April 2026 and 10 April 2026 and counts only the selected working days (Monday to Friday).

Total qualifying working days in this period: 8 days

Step 2: Waiting Days Applied

Because the employee has not received SSP in the last 8 weeks and waiting days are enabled, the first 3 qualifying days are unpaid.

Waiting days applied: 3 days

Step 3: Daily SSP Rate Calculation

The daily SSP rate is calculated by dividing the weekly SSP rate by the number of qualifying working days per week.

Daily SSP rate

= £118.75 ÷ 5

= £23.75 per day

Step 4: Eligible Paid Days

Eligible SSP days

= 8 qualifying days − 3 waiting days

= 5 paid days

Step 5: Total SSP Payable

Total SSP payable

= 5 × £23.75

= £118.75

Result Shown

Qualifying Days in Period: 8

Waiting Days Applied: 3

Daily SSP Rate: £23.75

Estimated SSP Payable: £118.75

Notice: This SSP calculator provides an estimated value only. Actual Statutory Sick Pay may vary depending on HMRC rules, employer payroll policies, SSP history, eligibility conditions, and maximum entitlement (up to 28 weeks). Tax and National Insurance deductions are not included.

Smarter Planning for Real-Life SSP Situations ?

This tool is especially useful for NHS staff managing long-term or repeated absences. Whether someone is tracking eligibility through a rolling sick pay calculator or reviewing records under a 12 month rolling sickness calculator period, it helps with calculating SSP accurately.

Staff often combine insights from an SSP calculator, SSP calculator UK, or SSP pay calculator to compare outcomes. Planning ahead also becomes easier when checking resources on the NHS Salary Calculators website or reviewing the NHS Sick Pay Benefits Overview,

particularly when estimating full pay entitlement and half pay entitlement using Calculator 2026. You can also cross-reference this with our related guide on NHS pay and benefits to build a complete financial picture.

Why Understanding Sick Pay Matters ?

Understanding how is NHS sick pay calculated is essential because policies vary depending on length of service, earnings, and absence history. Many employees assume SSP is separate, but in reality it often forms part of NHS sick pay. Knowing this prevents confusion when payments appear lower than expected. Awareness of the lower earnings limit also matters, as falling below it can affect eligibility.

Clear knowledge helps avoid mistakes, supports conversations with HR, and prepares staff for next steps such as Employment and Support Allowance if absence becomes extended. Financial confidence during illness supports wellbeing and ensures compliance with Department for Work and Pensions requirements, reducing stress at an already difficult time.

Costly Errors That Can Affect Your SSP Estimate

A frequent mistake is assuming SSP is paid in addition to NHS sick pay rather than included within it. Another is misjudging eligibility by ignoring the lower earnings limit or misunderstanding employer-specific rules.

Some staff also forget that SSP is capped at 28 weeks and do not plan early for alternatives such as ESA support administered by DWP. Relying solely on estimates without checking official guidance or using an SSP calc incorrectly can also lead to unrealistic expectations.

FAQs

Q1:- Can NHS employees receive SSP separately from NHS sick pay?

A:- In most cases, Statutory Sick Pay is included within NHS sick pay rather than paid as a separate amount.

Q2:- How long can statutory payments continue during sickness?

A:- Statutory Sick Pay is payable for up to 28 weeks during a period of sickness.

Q3:- What happens after SSP ends?

A:- After SSP ends, employees may be able to apply for Employment and Support Allowance depending on their circumstances.

Q4:- Who manages statutory sick pay rules in the UK?

A:- Statutory Sick Pay rules and benefit oversight are managed by the Department for Work and Pensions.

Q5:- Where can I check official SSP rules and rates?

A:- Official SSP rules and rates are available on the UK Government guidance page on the GOV.UK website.

Q6:- Does having multiple NHS contracts affect sick pay?

A:- Yes, Statutory Sick Pay is assessed separately for each employer if eligibility criteria are met.

Q7:- Are online estimators legally binding?

A:- No, online estimators provide estimates only and should be used alongside official policy guidance.