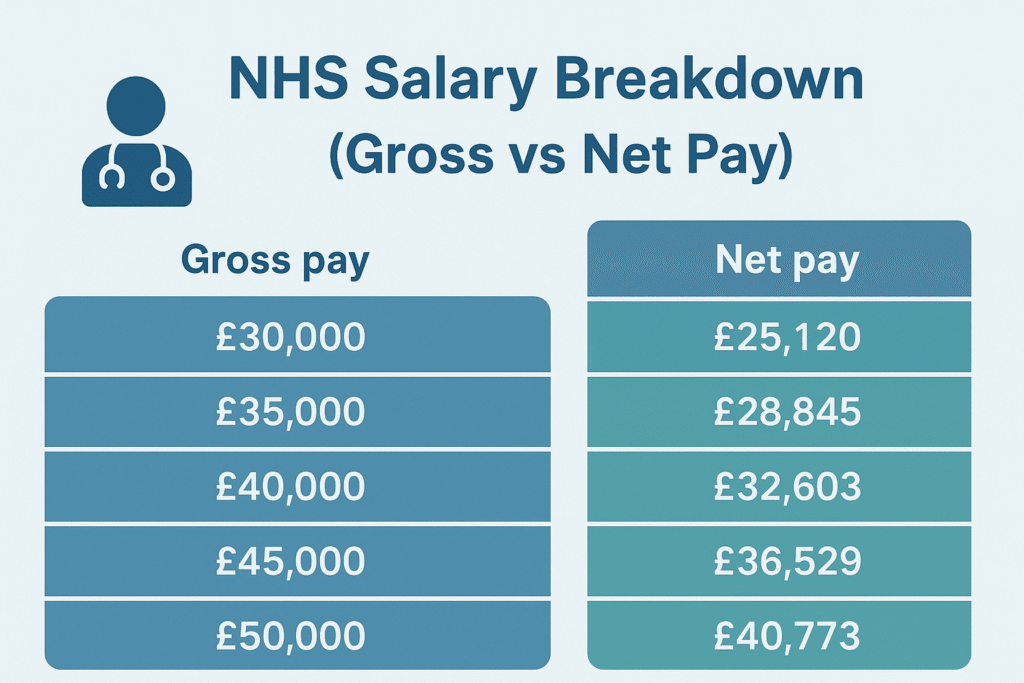

Every NHS employee receives a gross salary, but your net pay (take-home amount) is what lands in your bank.

Let’s break down the difference and see how each element affects what you actually earn.

What Is Gross Pay?

Gross pay = Your base salary (Band + Step) + any allowances or overtime.

Includes:

- Basic NHS pay

- High-cost area supplements (London weighting)

- On-call or night shift pay

- Overtime

It does not include tax or pension deductions.

What Is Net Pay?

Net pay = Gross Pay − Deductions

This is your actual take-home amount after:

- Income Tax

- National Insurance (NI)

- NHS Pension

- Salary Sacrifice schemes

Example Breakdown (Band 6 Step 2 – 2025)

| Component | Amount (£) |

|---|---|

| Gross Pay | 37,350 |

| Pension (9.8%) | −3,662 |

| Income Tax | −3,250 |

| National Insurance | −2,000 |

| Net Pay (Annual) | £28,438 |

| Monthly Take-Home | £2,370 |

Key Differences Between Gross & Net Pay

| Category | Gross Pay | Net Pay |

|---|---|---|

| Definition | Total before deductions | Amount after all deductions |

| Shown On Payslip | Top line | Bottom line |

| Tax Applied? | No | Yes |

| Pension Deducted? | No | Yes |

Why It’s Important

- Loan or mortgage applications use your gross pay.

- Personal budgeting uses your net pay.

- Understanding both helps you plan better for promotions and overtime.

More Topics

NHS Pay Bands Overview (Band 1 to Band 9)

How NHS Take-Home Pay is Calculated

FAQs

Q1: Are overtime payments part of gross or net pay?

They’re added to your gross pay and taxed before reaching net pay.

Q2: Why does my net pay vary monthly?

Because of variable overtime, tax thresholds, or deductions.

Q3: Can salary sacrifice reduce tax?

Yes — schemes like cycle-to-work reduce taxable income.