NHS salaries differ greatly between pay bands — but what matters most to staff is the take-home pay after tax, NI, and pension.

Here’s how it changes from Band 2 to Band 9 in 2025.

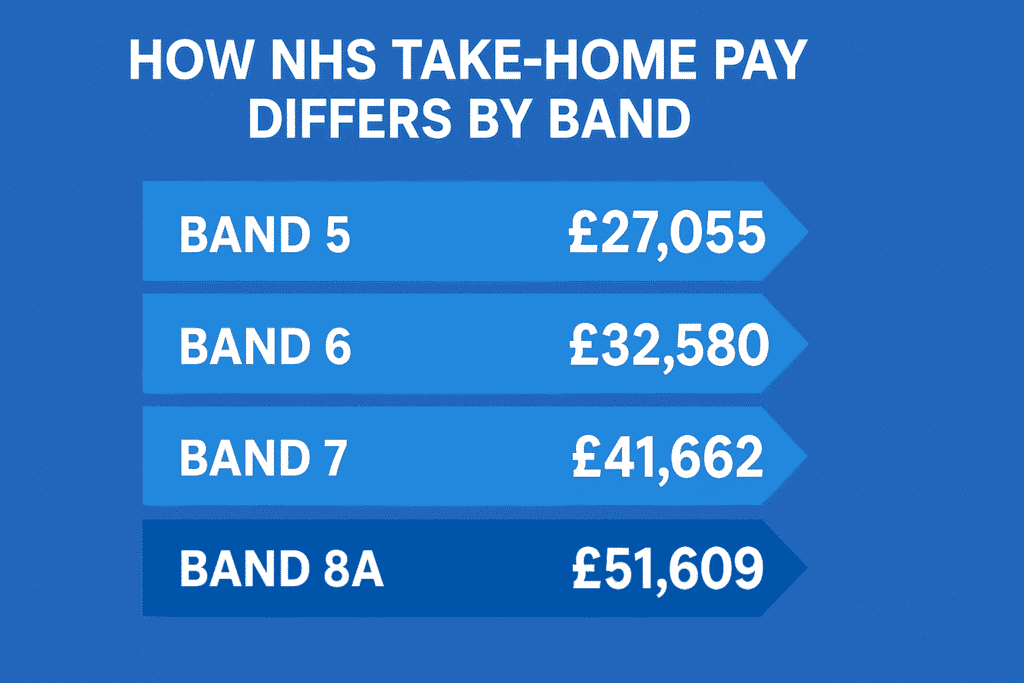

Take-Home Pay by NHS Band (2025)

| Band | Role Example | Annual Gross (£) | Net Pay (£) | Monthly (£) |

|---|---|---|---|---|

| Band 2 | Support Worker | 22,383 | 18,600 | 1,550 |

| Band 3 | Admin / HCA | 25,147 | 20,500 | 1,708 |

| Band 4 | Assistant / Clerk | 28,407 | 22,600 | 1,883 |

| Band 5 | Staff Nurse | 30,639 | 24,400 | 2,033 |

| Band 6 | Senior Nurse | 35,392 | 26,500 | 2,208 |

| Band 7 | Team Leader | 43,742 | 31,400 | 2,616 |

| Band 8a | Matron / Manager | 50,952 | 35,500 | 2,958 |

| Band 9 | Executive Director | 114,949 | 72,000 | 6,000 |

(Estimates include average pension deductions and 2025 UK tax bands.)

Key Observations

- Band 2–4 employees have lower pension rates (5–7%) → higher net %.

- Band 7+ staff contribute 9–11% pension, reducing take-home slightly.

- London weighting adds £3,000–£7,000 extra annually.

Why It Matters

✅ Helps compare promotions

✅ Assists in mortgage & budget planning

✅ Shows impact of pension tiers

✅ Useful for new NHS job applicants

More Topics