NHS Sick Pay Calculator 2025/26

Illness can affect more than just your health—it can impact finances, savings, and planning. NHS staff often face complex pay rules, reduced-pay periods, and service-based entitlements. That’s where a reliable calculation approach becomes essential. This guide explains how NHS sick pay works, what affects your earnings during periods of illness, and how estimates are made under current regulations.

Instead of guessing your take-home pay, you can plan confidently, protect your finances, and make informed career decisions. Whether you work full-time or part-time hours, repeated periods of illness can also push employees into a reduced-pay period, which is why advance clarity on sick leave nhs pay is essential.

Understanding your sick leave nhs pay helps you stay prepared for short-term absences, long-term absences, or even extended absences without unnecessary confusion.

What Is the NHS Sick Pay Calculator 2025/26 ?

The NHS Sick Pay Calculator 2025/26, also referred to as the NHS Sick Pay Calculator UK, is a practical tool designed to help NHS employees estimate how much NHS sick pay they may receive during sickness absence. It is based on official NHS terms and conditions and follows Agenda for Change rules.

By using factors such as annual salary, length of NHS service, number of sick days taken, and part-time hours, it reflects your nhs sick pay entitlement and nhs sick leave entitlement accurately. Many employees also compare results with a private sick pay calculator NHS to understand differences with private sector arrangements.

This type of sickness calculator or sick leave calculator simplifies complex policies into easy-to-understand figures, making it easier to plan finances during a reduced-pay period. Many staff also refer to it as an nhs sick pay entitlement calculator, as it focuses on service-based entitlements rather than assumptions.

How the NHS Sick Pay Calculation Works ?

The calculation process depends largely on your nhs sick pay length of service. NHS sick pay policy provides different levels of support depending on how long you have worked within the NHS. For newer staff, entitlement may be limited, while long-serving employees often qualify for extended full-pay and half-pay periods.

The sick pay NHS calculator considers your basic annual salary only. It excludes overtime earnings, enhancements, or local allowances, ensuring compliance with national sick pay rules. For part-time hours, calculations are automatically adjusted so estimates remain fair and accurate.

The system also tracks nhs sick pay 6 months rules, clearly showing when full pay ends and when half pay begins. Reset periods are important too; nhs sick pay reset periods determine how previous absences within rolling timeframes affect future entitlement. Employees often use an NHS half pay calculator to understand exactly when their full pay transitions to half pay.

The calculation also considers repeated periods of illness within a rolling timeframe, which may result in a reduced-pay period even if absences occur months apart.

Annual updates and regulations, including nhs sick pay entitlement 2025, are applied so figures remain current. Many employees use this alongside the NHS pay and benefits suite to understand pension contributions, annual leave entitlements, take-home pay, and overall NHS compensation package.

Tools like the NHS pay rise and inflation impact calculator further help assess real pay growth and income protection options during illness. This helps employees clearly understand sick leave nhs pay and how NHS benefits compare with private sector arrangements when reviewing long-term employment choices. For deeper understanding of related benefits, you can also explore our internal guide on NHS pay and allowances.

How Sick Pay Is Calculate ?

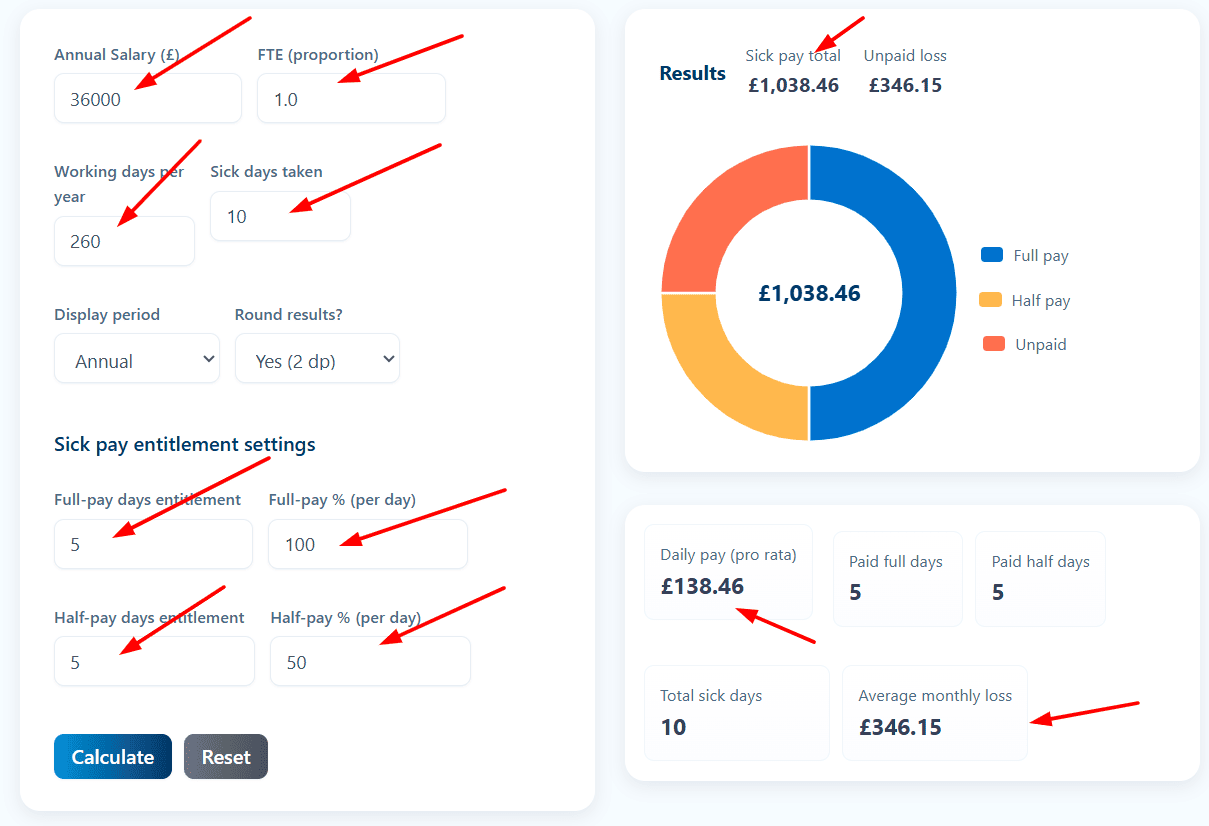

Example 1: Full Pay + Half Pay

Suppose your annual salary is £36,000, you work full-time (FTE 1.0), and you take 10 sick days — with 5 days at full pay and 5 days at half pay, how much sick pay will you receive?

Input values (Image 1 – Form filled)

- Annual Salary: £36,000

- FTE: 1.0

- Working days per year: 260

- Sick days taken: 10

- Full-pay entitlement: 5 days (100%)

- Half-pay entitlement: 5 days (50%)

How calculation works (Explain above image)

- Daily pay = £36,000 ÷ 260 = £138.46

- 5 sick days paid at full pay

- 5 sick days paid at half pay

Result shown

- Full pay received: £692.30

- Half pay received: £346.15

- Total sick pay: £1,038.45

- Unpaid loss: £0

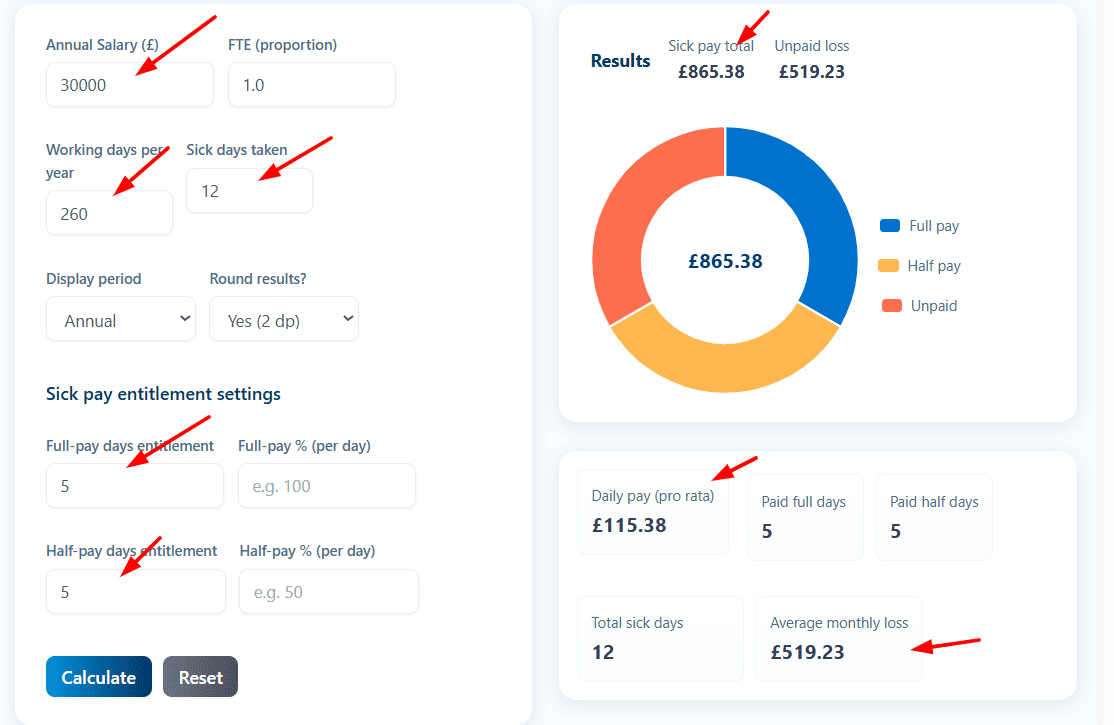

Example 2: Unpaid Sick Days Scenario

Suppose: you earn £30,000 a year and take 12 sick days, but only 10 days are paid — how much sick pay will you receive and how much will be unpaid?

👉 Input values (Image 2 – Form filled)

- Annual Salary: £30,000

- FTE: 1.0

- Working days per year: 260

- Sick days taken: 12

- Full-pay entitlement: 5 days

- Half-pay entitlement: 5 days

🧮 Explanation

- Daily pay = £30,000 ÷ 260 = £115.38

- Paid full days: 5

- Paid half days: 5

- Remaining sick days: 2 (unpaid)

✅ Result shown

- Full pay: £576.90

- Half pay: £288.45

- Unpaid loss: £230.76

- Total sick pay: £865.35

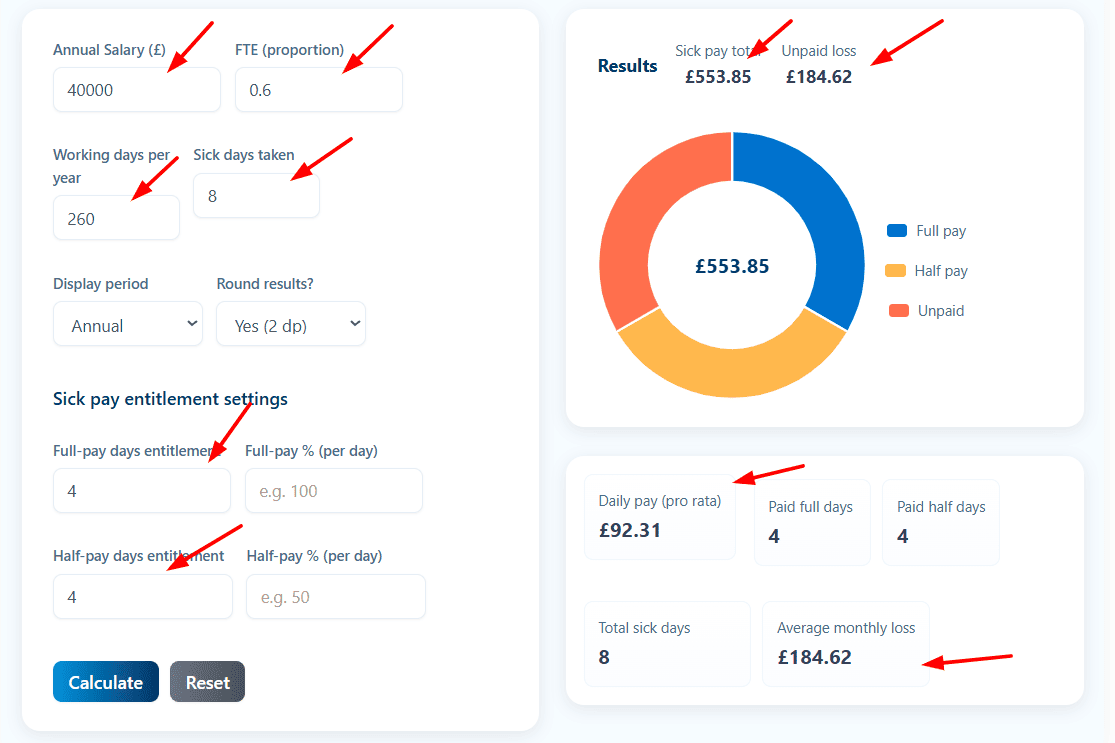

Example 3: Part-Time Employee (FTE based)

Suppose: you earn £40,000 a year but work part-time at FTE 0.6 and take 8 sick days — how much sick pay will you receive ?

👉 Input values

- Annual Salary: £40,000

- FTE: 0.6

- Working days per year: 260

- Sick days taken: 8

- Full-pay entitlement: 4 days

- Half-pay entitlement: 4 days

🧮 Explanation

- Adjusted salary = £40,000 × 0.6 = £24,000

- Daily pay = £24,000 ÷ 260 = £92.31

- 4 days full pay, 4 days half pay

✅ Result shown

- Full pay: £369.24

- Half pay: £184.62

- Total sick pay: £553.86

- Unpaid loss: £0

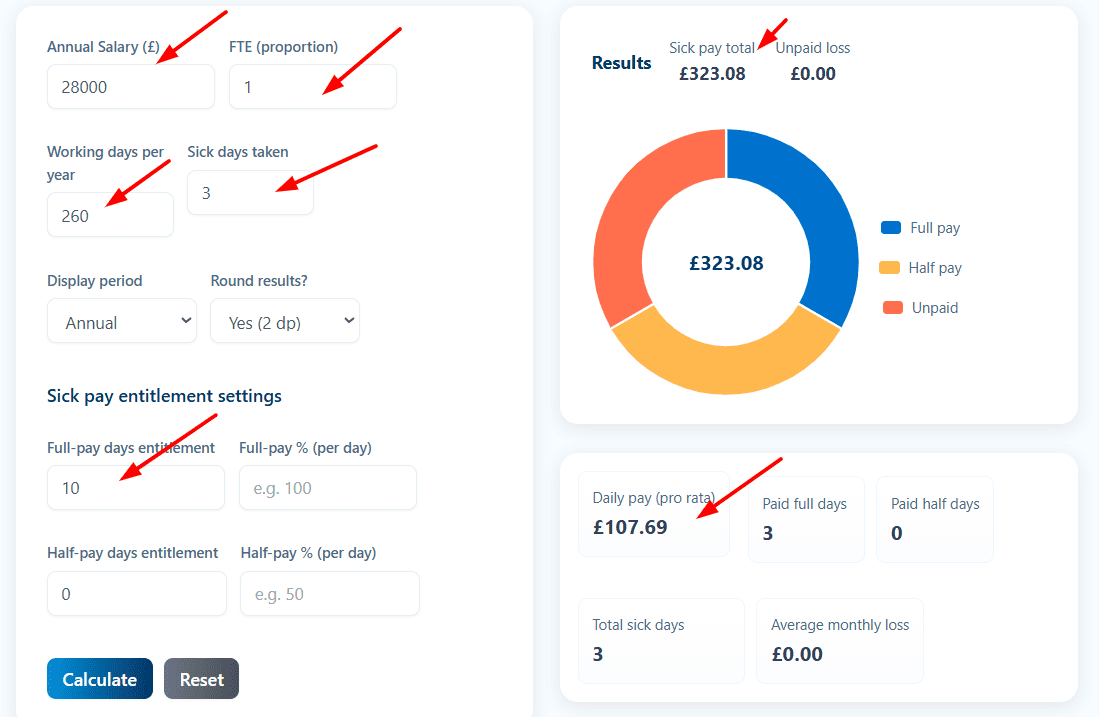

Example 4: All Sick Days Paid at Full Pay

Suppose: you earn £28,000 a year and take 3 sick days, all covered at full pay — how much sick pay will you receive?

👉 Input values

- Annual Salary: £28,000

- FTE: 1

- Working days per year: 260

- Sick days taken: 3

- Full-pay entitlement: 10 days

- Half-pay entitlement: 0 days

🧮 Explanation

- Daily pay = £28,000 ÷ 260 = £107.69

- All sick days covered at full pay

✅ Result shown

- Full pay: £323.07

- Half pay: £0

- Unpaid loss: £0

- Total sick pay: £323.07

Notice: This is an estimate only. Actual figures may vary based on individual circumstances, employment rights, and official NHS regulations.

Why NHS Employees Should Understand Sick Pay ?

Knowing how NHS sick pay works helps staff manage finances during periods of illness without panic. It supports better career decisions, realistic budgeting, and awareness of income protection options. When combined with an absence calculator and sick pay UK calculator, employees gain clarity over take-home pay, pension contributions, and long-term financial stability.

Understanding these rules also helps avoid surprises when moving from full pay to half pay or returning after long-term absences. This comparison is especially useful for staff weighing NHS security against private sector arrangements and alternative benefit structures.

Common Mistakes NHS Staff Make

Many employees assume overtime earnings or allowances are included, which they are not. Others overlook rolling absence rules or misunderstand reset periods. Some rely solely on estimates without checking official NHS terms and conditions.

Not accounting for part-time adjustments or confusing NHS sick pay with private sector benefits can also lead to incorrect expectations. Another common mistake is ignoring how multiple periods of illness can quickly trigger a reduced-pay period, even when absences seem unrelated.

FAQs

Q:1- how is income tax calculated in singapore?

A:- Income tax in Singapore is calculated using progressive resident tax rates applied to your chargeable income after allowable reliefs. For official guidance, refer to the Inland Revenue Authority of Singapore at iras.gov.sg .

Q:2- how to calculate chargeable income singapore?

A:- Chargeable income is calculated by subtracting allowable deductions and reliefs from your total income earned in Singapore.

Q:3- how to calculate tax in singapore?

A:- You calculate tax by applying the relevant tax rates to each income bracket of your chargeable income, then summing the total tax payable.

Q:4- how to calculate income tax singapore?

A:- Income tax in Singapore is calculated annually based on residency status, chargeable income, and applicable tax rates set by the government.